Flexi Cap Funds offer dynamic asset allocation across large-cap, mid-cap, and small-cap companies. Fund managers can shift weightage based on market opportunities, making these funds ideal for investors aiming for long-term wealth creation with controlled risk.

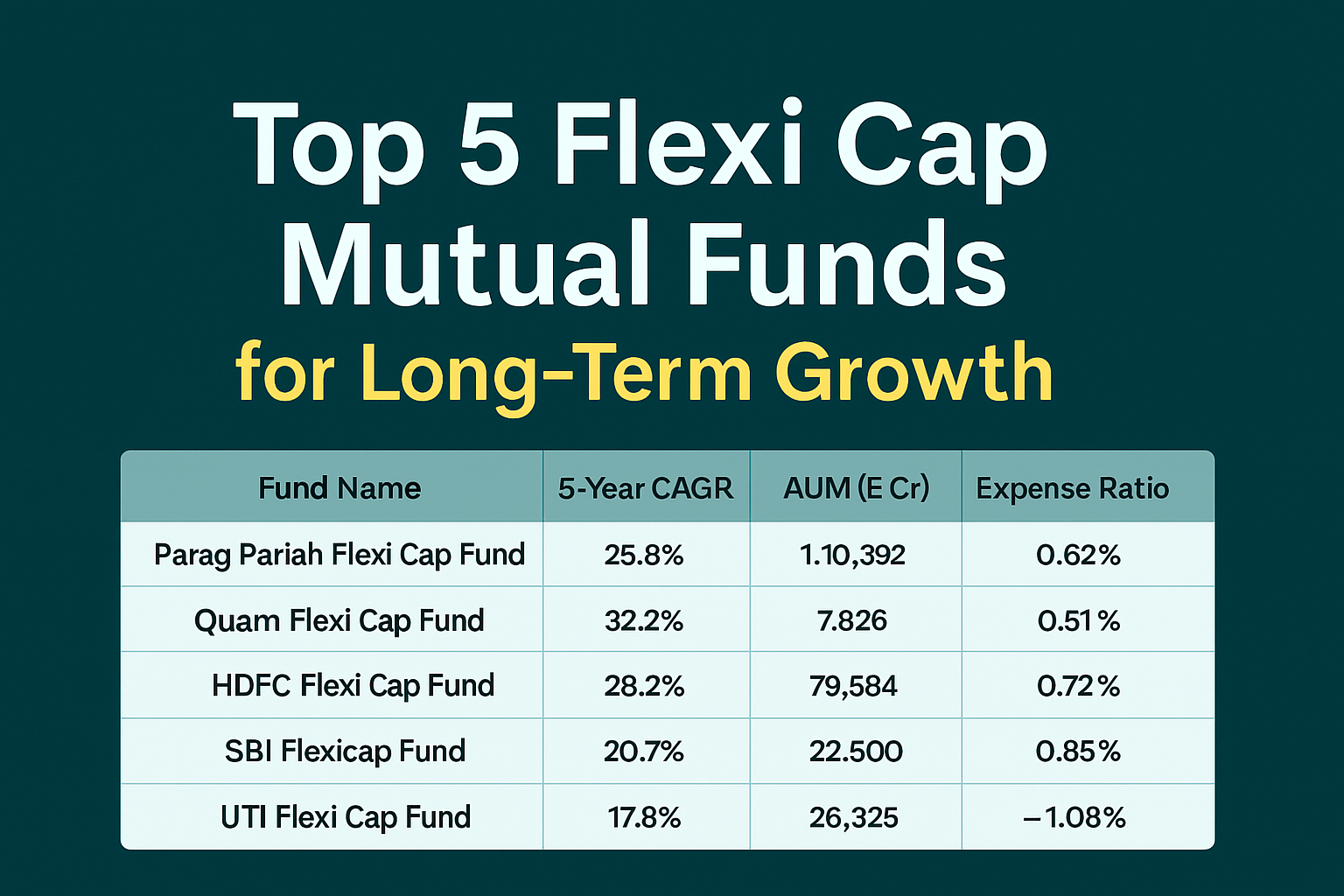

| Fund | 5‑Yr CAGR | AUM (₹ Cr) | Expense Ratio (Direct) | Min SIP | Fund Managers |

|---|---|---|---|---|---|

| Parag Parikh Flexi Cap Fund | 25.8% | 1,10,392 | 0.63% | ₹1,000 | Rajeev Thakkar, Raunak Onkar |

| Quant Flexi Cap Fund | 32.3% | 7,326 | 0.61% | ₹1,000 | Ankit Pande, Sanjeev Sharma |

| HDFC Flexi Cap Fund (Direct Growth) | 29.2% | 79,584 | 0.72% | ₹100 | Prashant Jain, Roshi Jain |

| SBI Flexicap Fund (Direct Growth) | 20.7% | 22,500 | 0.85% | ₹500 | R. Srinivasan |

| UTI Flexi Cap Fund (Direct Growth) | 17.97% | 26,325 | 1.00% | ₹500 | Ajay Tyagi |

1. Parag Parikh Flexi Cap Fund

- AUM: ₹1,10,392 Cr

- 5‑Year CAGR: 25.8%

- Expense Ratio: 0.63%

- Why Choose: Consistent performance with global exposure and value-investing strategy

2. Quant Flexi Cap Fund

- AUM: ₹7,326 Cr

- 5‑Year CAGR: 32.3%

- Expense Ratio: 0.61%

- Why Choose: High-growth, momentum-based tactical fund ideal for aggressive investors

3. HDFC Flexi Cap Fund

- AUM: ₹79,584 Cr

- 5‑Year CAGR: 29.2%

- Expense Ratio: 0.72%

- Why Choose: Managed by veteran fund managers with a long-term growth strategy and strong stock selection

4. SBI Flexicap Fund

- AUM: ₹22,500 Cr

- 5‑Year CAGR: 20.7%

- Expense Ratio: 0.85%

- Why Choose: Balanced allocation between large and mid-cap stocks, ideal for moderate-risk investors

5. UTI Flexi Cap Fund

- AUM: ₹26,325 Cr

- 5‑Year CAGR: 17.97%

- Expense Ratio: 1.00%

- Why Choose: Quality stock picks with consistent long-term returns

Why These Funds?

- Strong historical returns over the last 5 years

- Well-established fund houses with trusted fund managers

- Suitable for a long-term goal of 10+ years

- Offer a good balance of risk and reward through market cycle flexibility

Best Practices for Investing in Flexi Cap Funds

- Choose Direct-Growth Plans for lower expense ratios and higher returns

- Stay invested for at least 10 years to benefit from compounding

- Avoid switching based on short-term volatility

- Review fund performance annually

FAQ

Q. What is the ideal investment duration for Flexi Cap funds?

A. Minimum of 7 to 10 years is recommended for optimal returns.

Q. Are Flexi Cap funds safe?

A. They carry moderate to high risk, but the flexibility in allocation helps manage volatility better than pure small or mid-cap funds.

Q. Should I invest via SIP or lumpsum?

A. SIP is the preferred method to average cost and reduce risk over time.

Q. What is the key difference between Flexi Cap and Multi Cap funds?

A. Multi Cap funds must invest at least 25% each in large, mid, and small-cap stocks, while Flexi Cap funds have no such restriction and are more flexible.

Disclaimer

Mutual fund investments are subject to market risks. Past performance is not indicative of future returns. Data accurate as of 14 July 2025. Please consult your financial advisor before investing.